Imagine leaving the physical doors of your business unlocked overnight. The thought is unsettling, isn’t it? You wouldn’t risk your assets, your hard work, and the trust of your clients like that. That’s precisely the risk many small to medium-sized businesses (SMBs) unknowingly take by underestimating the importance of cybersecurity. Let’s explore just how important proper cybersecurity truly is.

In the interest of communicating how critical proper business cybersecurity is to manage, we’ve decided to take a different approach and put forth a scenario in the form of a daytime soap. As such, please feel free to read this post with dramatic music playing in the background and all dialogue imagined with elevated intensity. In the town of Oak Falls, life seems peaceful… but under the surface, tension persists. Secrets run amok, and with so much information to take in, everyone has to worry about the Strength of Our Passwords.

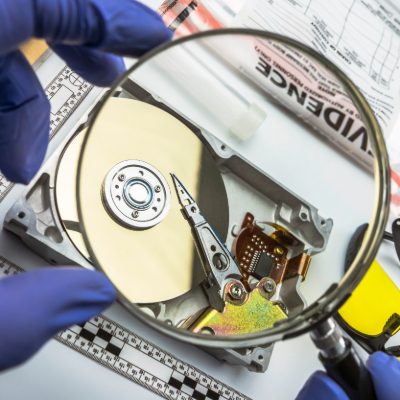

How much data do your devices contain about your life? What would you do if law enforcement suddenly wanted access to it? Even if you’re a typical law-abiding citizen, you want to prioritize data privacy, but businesses also have an obligation to handle consumer information in a responsible way. Here’s what you need to know about law enforcement and access to your data.

Cybercrime is a real problem for businesses and individuals alike. Today, there are more threats than ever and even if you are careful, data theft can affect you. In our blog today, we thought we would go through the ways that data theft can affect you, even if it isn’t stolen directly from you.

What happens to all the data that gets stolen by hackers during their despicable campaigns? Sometimes it gets destroyed, but more often than not, it ends up on the Dark Web, where it’s put to other nefarious purposes. Today, we want to discuss the Dark Web and why it’s so important you monitor it for your business’ data.

While most browsers offer a bookmark feature, allowing a user to save certain web pages for repeated viewing, Google Chrome adds to this with an added functionality: Google Saved. Previously known as Google Collections, Google Saved gives users a convenient place to keep track of things they want to return to later… similar to a bookmark, but more so.

Collaboration is super important for all kinds of businesses today, especially because so much work is done online. With so many people working from home, it’s clear that businesses need a safe way to work together successfully.

If you’re a regular reader of this blog, you’ve probably come across articles on blockchain before. This week, we’re shifting gears to explore a new topic: should cryptocurrency, which is enabled by blockchain technology, be subject to taxation by state, federal, and international authorities? Let’s dive into what blockchain is, how it supports cryptocurrency, and the ongoing debate about potential taxation.

Let me ask you this: would you trust every one of your team members with a key to your house? Of course not, right? After all, what if someone lost their copy or had it stolen from them? So, if you wouldn’t trust your entire team with access to your home, why on earth would you trust them with carte blanche access to your entire business and all of its data? That’s just it… you wouldn’t.

Having your team connected through mobile, especially with access to collaboration and communication tools, is the new normal in business. Many organizations take advantage of the ubiquity of smartphones and either provide mobile devices to their staff or utilize the built-in options on many of today’s newest mobile OSs that allow them to put an encrypted work profile on; effectively adding mobility to your business without a huge capital investment. Regardless of what option you choose, you need to have management software in place if you are going to trust your employees to have access to company information outside of the office.